csriram45

09-09 05:59 PM

Came to US in Aug 1997. My first company start up closed in 2002 recession and so joined another which by the time started the process etc.. delayed till Sep 2004 PD with EB3.

13 years in the US and waiting....

13 years in the US and waiting....

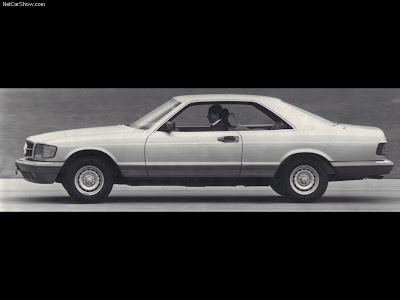

wallpaper Wald Mercedes-Benz S-Class

skv

06-25 10:25 AM

No

Hi,

Back again, I'm counting the days for the PERM approval at Atlanta, hope we all be able to file, before the retro kicks in. :)

Hi,

Back again, I'm counting the days for the PERM approval at Atlanta, hope we all be able to file, before the retro kicks in. :)

she81

08-13 04:44 PM

Till last year EB 3 would get additional visa from the leftovers of ROW, both EB2 and EB 3-I would benefit from the ROW visia, now all the visas are going to EB2, so i agree with you, there is little hope for EB 3.

Why are there no repurcussions if USCIS admits that they were incorrectly allocating the visa earlier. they can suddenly change the rules and everybody keeps quiet....strange.

Thats USCIS - Uncertain Surreptitious and Careless Institution to Select future immigrants.

Why are there no repurcussions if USCIS admits that they were incorrectly allocating the visa earlier. they can suddenly change the rules and everybody keeps quiet....strange.

Thats USCIS - Uncertain Surreptitious and Careless Institution to Select future immigrants.

2011 Mercedes-Benz : S-Class 2001

gaz

09-10 12:20 AM

the construction boom has seen some upward movement in the lower classes also. try finding an electrician or plumber in any big city in India to do some small chore.

also remember that the big cities (Mumbai, Delhi, Chennai, Hyd/Secunderabad, NOIDA, Guragaon etc. and satellite areas) are seeing the huge rise in prices. These also coincide with the centers of tremendous progress and huge purchase power for people. Smaller cities also have a hike in prices but nothing comparable. So the average Indian does not really get affected a lot. The average city dweller is either renting by paying a ton of money or is spending a ton of money for a house. Scary thing is either ways they are able to afford it. Makes the US salary seem meaningless in comparison (comparing quality of life here and not just money).

[quote] to add to the conversation on the price -> locals are also experiencing a glut of money due to the economic boom in the last 5 years or so. Small businesses have really taken off in a big way exporting to Europe/ US. Investors in the stock market have also hit the jackpot. And, once you have money, for most Indians the safest option to invest is in property or gold.

Also better salaries all around fueled by attrition of talent to the IT sector. [quote]

This may be correct to certain extent but only the elite class and creamy layer of 1.8% of total population. When we look at the bigger picture of the country, I could not connect the dots. GDP is just above $2500 and PPP is about $3300. How in the world will you justify $200,000 to $300,000. Plus the cost of financing the purchase.

In simple terms, median home price is 100 times the GDP and life expectancy in india is 70 years. average work life span is 40 years. Home Mortgages are 15, 20 or 25 years in India which will cover only 1/4th of the median price of a home based on even anticipated high GDP growth and considering moderate increase in cost of living. Given that the risk of default is huge and banks are running at very high risk. I believe buying a house is a big gamble in India and more to that for Banks, lending is also a big gamble.

Note that according to banks, investment in apartments capitalize only over 25 years in india. (Rent vs. Own) Is this correct? Average rentals in ONLY Big cities are Rs. 12000 ($275 / month $3300 a year) to 15000 ($340 / month $4000 a year) for the same 1000 sqft 2 bedroom apartments which itself is above the GDP :). What that tells me, even the rentals are also not affordable to majority of the population. Back to captalization part 4000 * 25 = 100,000. which is half of the investment... add the alternate investment value for 25 years, capitalization will be way below 50%.

That means it will take more than 50 years to capatilize the investment. This is more that Mod average work life span of 40 years. Note that Maintenance and Taxes for 25 years excluded in above calc. Are banks stupid?

I do not know what to tell ya man! To me its really scary

A small credit crunch (crisis is not required) might bring the entire economy to floor.

fine print: (Above analysis applies only for working taxpaying people like us who does not have unaccounted money.)

also remember that the big cities (Mumbai, Delhi, Chennai, Hyd/Secunderabad, NOIDA, Guragaon etc. and satellite areas) are seeing the huge rise in prices. These also coincide with the centers of tremendous progress and huge purchase power for people. Smaller cities also have a hike in prices but nothing comparable. So the average Indian does not really get affected a lot. The average city dweller is either renting by paying a ton of money or is spending a ton of money for a house. Scary thing is either ways they are able to afford it. Makes the US salary seem meaningless in comparison (comparing quality of life here and not just money).

[quote] to add to the conversation on the price -> locals are also experiencing a glut of money due to the economic boom in the last 5 years or so. Small businesses have really taken off in a big way exporting to Europe/ US. Investors in the stock market have also hit the jackpot. And, once you have money, for most Indians the safest option to invest is in property or gold.

Also better salaries all around fueled by attrition of talent to the IT sector. [quote]

This may be correct to certain extent but only the elite class and creamy layer of 1.8% of total population. When we look at the bigger picture of the country, I could not connect the dots. GDP is just above $2500 and PPP is about $3300. How in the world will you justify $200,000 to $300,000. Plus the cost of financing the purchase.

In simple terms, median home price is 100 times the GDP and life expectancy in india is 70 years. average work life span is 40 years. Home Mortgages are 15, 20 or 25 years in India which will cover only 1/4th of the median price of a home based on even anticipated high GDP growth and considering moderate increase in cost of living. Given that the risk of default is huge and banks are running at very high risk. I believe buying a house is a big gamble in India and more to that for Banks, lending is also a big gamble.

Note that according to banks, investment in apartments capitalize only over 25 years in india. (Rent vs. Own) Is this correct? Average rentals in ONLY Big cities are Rs. 12000 ($275 / month $3300 a year) to 15000 ($340 / month $4000 a year) for the same 1000 sqft 2 bedroom apartments which itself is above the GDP :). What that tells me, even the rentals are also not affordable to majority of the population. Back to captalization part 4000 * 25 = 100,000. which is half of the investment... add the alternate investment value for 25 years, capitalization will be way below 50%.

That means it will take more than 50 years to capatilize the investment. This is more that Mod average work life span of 40 years. Note that Maintenance and Taxes for 25 years excluded in above calc. Are banks stupid?

I do not know what to tell ya man! To me its really scary

A small credit crunch (crisis is not required) might bring the entire economy to floor.

fine print: (Above analysis applies only for working taxpaying people like us who does not have unaccounted money.)

more...

priti8888

07-18 06:03 PM

priti8888,

That is not true. Receipt Date is when the service center physically receives the package. They date stamp it and then use it to enter that RD when they generate the Notice on the ND.

What you see on the status page for sure reflects the ND and NOT the RD. So you can pretty much ignore what the status page says and rely on what your physical notice says (it states the actual RD when they physically received the package!)

Hope this is a clear explanation.

Oh really!..then i might be wrong. So RD is before the ND

THANKS Shreekhand

That is not true. Receipt Date is when the service center physically receives the package. They date stamp it and then use it to enter that RD when they generate the Notice on the ND.

What you see on the status page for sure reflects the ND and NOT the RD. So you can pretty much ignore what the status page says and rely on what your physical notice says (it states the actual RD when they physically received the package!)

Hope this is a clear explanation.

Oh really!..then i might be wrong. So RD is before the ND

THANKS Shreekhand

diptam

08-11 11:53 PM

Agree with you 100% - But Once you start a thread with assertive words peoples start relying on you.... I also posted lots of conversations between myself and USCIS but i was never assertive.

Anyway - this argument will go on forever.

Can we request SriKondoJi/likes not to post anything with strong Affirmative words unless they have some kind of confirmations beyond the general Public's assumption ??

Thanks

Hello,

I think this is high time for us to control our emotions and live with realities. Often times, the customer service representatives don't have up-to-date information of USCIS's policies, decisions, and announcements, and we should not take their response as granted. For example, If you call a service center 5 times a day and ask a same question, you will get five different answers. In fact, Srikondoji mentioned what he had heard from NSC customer service staff. So, we can blame neither Srikondoji, nor customer service staff, but only USCIS.:)

Regards,

IK

Anyway - this argument will go on forever.

Can we request SriKondoJi/likes not to post anything with strong Affirmative words unless they have some kind of confirmations beyond the general Public's assumption ??

Thanks

Hello,

I think this is high time for us to control our emotions and live with realities. Often times, the customer service representatives don't have up-to-date information of USCIS's policies, decisions, and announcements, and we should not take their response as granted. For example, If you call a service center 5 times a day and ask a same question, you will get five different answers. In fact, Srikondoji mentioned what he had heard from NSC customer service staff. So, we can blame neither Srikondoji, nor customer service staff, but only USCIS.:)

Regards,

IK

more...

newbee7

07-05 11:04 PM

http://www.nytimes.com/2007/07/06/us/06visa.html?hp

Can someone please put this on digg?

***

To complete the applications in time, the immigration agency put employees to work both days last weekend at service centers in Texas and Nebraska, immigration officials said. They said that 25,000 applications were processed in the final 48 hours before Monday’s deadline.

In some cases, security clearances required by the F.B.I. were not entirely completed, immigration officials said. The agency approved some applications “when we were certain the process will be completed very shortly,” Mr. Aytes said.

*****

Can someone please put this on digg?

***

To complete the applications in time, the immigration agency put employees to work both days last weekend at service centers in Texas and Nebraska, immigration officials said. They said that 25,000 applications were processed in the final 48 hours before Monday’s deadline.

In some cases, security clearances required by the F.B.I. were not entirely completed, immigration officials said. The agency approved some applications “when we were certain the process will be completed very shortly,” Mr. Aytes said.

*****

2010 2004 Wald Mercedes Benz S

qualified_trash

08-08 03:40 PM

OK, I edited the text to make it clearer that 20-25 years applies only to some family based immigrants. Let me know if it reads OK (grammar etc.) after the edits.

Pankaj

As this is your article, you have all the freedom to write on what impacts you. However, keep in mind that FB immigration is still a sore spot with the American public as the perception is that Immigrants bring their parents here to collect on SS and Medicare (true in some cases I guess). If it were left up to me, I would leave FB Immigration out of the writeup.......

Just my 2 cents.

Grammar etc looks fine to me :-))

Pankaj

As this is your article, you have all the freedom to write on what impacts you. However, keep in mind that FB immigration is still a sore spot with the American public as the perception is that Immigrants bring their parents here to collect on SS and Medicare (true in some cases I guess). If it were left up to me, I would leave FB Immigration out of the writeup.......

Just my 2 cents.

Grammar etc looks fine to me :-))

more...

Green.Tech

06-02 10:55 AM

Don't let the visa bulletins work you every month, every year, year after year....Support IV to make the visa bulletins work for you...

hair 2004 Wald Mercedes-Benz

chanduv23

09-13 03:21 PM

Order Details - Sep 13, 2007 12:40 PM GMT-07:00

Google Order #949176417011663

Great, and please make it to the rally

Google Order #949176417011663

Great, and please make it to the rally

more...

vparam

09-24 03:07 PM

it has to be similar job PLUS with an established company.

from what i have gathered it seems that if USCIS issues a RFE or calls u for interview during adjucation they might ask for 2 yrs of tax filings of future employer to prove that it's an established company (although they are not suppposed to bring up 'ability to pay' issue which is already covered in approved 140 -- but being USCIS anything goes...).

i also wondered about the conflict of interest becoz it's your relative that u clearly identified in your G325 (Biographic) form -- but I guess if ppl are doing it then it's possible.

You can be self employed used that for AC 21 as per yates memo. In that case wht does it matter if you are working for your wife's company. since it allows you to work just by yoru self ( self employment == own your own company)

from what i have gathered it seems that if USCIS issues a RFE or calls u for interview during adjucation they might ask for 2 yrs of tax filings of future employer to prove that it's an established company (although they are not suppposed to bring up 'ability to pay' issue which is already covered in approved 140 -- but being USCIS anything goes...).

i also wondered about the conflict of interest becoz it's your relative that u clearly identified in your G325 (Biographic) form -- but I guess if ppl are doing it then it's possible.

You can be self employed used that for AC 21 as per yates memo. In that case wht does it matter if you are working for your wife's company. since it allows you to work just by yoru self ( self employment == own your own company)

hot 2003 Wald Mercedes Benz S

gc_maine2

04-04 10:27 AM

:confused::confused:

I am excerpting Internal Revenue Code Section 1361 below:

Internal Revenue Code

� 1361 S corporation defined.

(a) S corporation defined.

(1) In general.

For purposes of this title, the term �S corporation� means, with respect to any taxable year, a small business corporation for which an election under section 1362(a) is in effect for such year.

(2) C corporation.

For purposes of this title, the term �C corporation� means, with respect to any taxable year, a corporation which is not an S corporation for such year.

(b) Small business corporation.

(1) In general.

For purposes of this subchapter, the term �small business corporation� means a domestic corporation which is not an ineligible corporation and which does not�

(A) have more than 100 shareholders,

(B) have as a shareholder a person (other than an estate, a trust described in subsection (c)(2) , or an organization described in subsection (c)(6) ) who is not an individual,

(C) have a nonresident alien as a shareholder, and

(D) have more than 1 class of stock.

(2) Ineligible corporation defined.

For purposes of paragraph (1) , the term �ineligible corporation� means any corporation which is�

(A) a financial institution which uses the reserve method of accounting for bad debts described in section 585 ,

(B) an insurance company subject to tax under subchapter L,

(C) a corporation to which an election under section 936 applies, or

(D) a DISC or former DISC.

There is no mention here that the "resident" must be a permanent resident.

Here is an excerpt of the Federal Regulation that defines who is a "resident alien" for taxation purposes:

Reg �1.871-2. Determining residence of alien individuals.

Caution: The Treasury has not yet amended Reg � 1.871-2 to reflect changes made by P.L. 108-357

(a) General. The term �nonresident alien individual� means an individual whose residence is not within the United States, and who is not a citizen of the United States. The term includes a nonresident alien fiduciary. For such purpose the term �fiduciary� shall have the meaning assigned to it by section 7701(a)(6) and the regulations in Part 301 of this chapter (Regulations on Procedure and Administration). For presumption as to an alien's nonresidence, see paragraph (b) of �1.871-4.

(b) Residence defined. An alien actually present in the United States who is not a mere transient or sojourner is a resident of the United States for purposes of the income tax. Whether he is a transient is determined by his intentions with regard to the length and nature of his stay. A mere floating intention, indefinite as to time, to return to another country is not sufficient to constitute him a transient. If he lives in the United States and has no definite intention as to his stay, he is a resident. One who comes to the United States for a definite purpose which in its nature may be promptly accomplished is a transient; but, if his purpose is of such a nature that an extended stay may be necessary for its accomplishment, and to that end the alien make his home temporarily in the United States, he becomes a resident, though it may be his intention at all times to return to his domicile abroad when the purpose for which he came has been consummated or abandoned. An alien whose stay in the United States is limited to a definite period by the immigration laws is not a resident of the United States within the meaning of this section, in the absence of exceptional circumstances.

Here is the relevant Federal Regulation on Proof of Residence for determining status for tax purposes:

Reg �1.871-4. Proof of residence of aliens.

(a) Rules of evidence. The following rules of evidence shall govern in determining whether or not an alien within the United States has acquired residence therein for purposes of the income tax.

(b) Nonresidence presumed. An alien, by reason of his alienage, is presumed to be a nonresident alien.

(c) Presumption rebutted.

(1) Departing alien. In the case of an alien who presents himself for determination of tax liability before departure from the United States, the presumption as to the alien's nonresidence may be overcome by proof�

(i) That the alien, at least six months before the date he so presents himself, has filed a declaration of his intention to become a citizen of the United States under the naturalization laws; or

(ii) That the alien, at least six months before the date he so presents himself, has filed Form 1078 or its equivalent; or

(iii) Of acts and statements of the alien showing a definite intention to acquire residence in the United States or showing that his stay in the United States has been of such an extended nature as to constitute him a resident.

(2) Other aliens. In the case of other aliens, the presumption as to the alien's nonresidence may be overcome by proof�

(i) That the alien has filed a declaration of his intention to become a citizen of the United States under the naturalization laws; or

(ii) That the alien has filed Form 1078 or its equivalent; or

(iii) Of acts and statements of the alien showing a definite intention to acquire residence in the United States or showing that his stay in the United States has been of such an extended nature as to constitute him a resident.

(d) Certificate. If, in the application of paragraphs (c)(1)(iii) or (2)(iii) of this section, the internal revenue officer or employee who examines the alien is in doubt as to the facts, such officer or employee may, to assist him in determining the facts, require a certificate or certificates setting forth the facts relied upon by the alien seeking to overcome the presumption. Each such certificate, which shall contain, or be verified by, a written declaration that it is made under the penalties of perjury, shall be executed by some credible person or persons, other than the alien and members of his family, who have known the alien at least six months before the date of execution of the certificate or certificates.

(c) Application and effective dates. Unless the context indicates otherwise, ��1.871-2 through 1.871-5 apply to determine the residence of aliens for taxable years beginning before January 1, 1985. To determine the residence of aliens for taxable years beginning after December 31, 1984, see section 7701(b) and ��301.7701(b)-1 through 301.7701(b)-9 of this chapter. However, for purposes of determining whether an individual is a qualified individual under section 911(d)(1)(A), the rules of ��1.871-2 and 1.871-5 shall continue to apply for taxable years beginning after December 31, 1984. For purposes of determining whether an individual is a resident of the United States for estate and gift tax purposes, see �20.0-1(b)(1) and (2) and � 25.2501-1(b) of this chapter, respectively.

In summary, I submit to you that if you work in the US for more than 6 months out of a given year, you are a resident alien, and therefore are eligible to set up an S-Corp.

Since I am still learning about this, any input/feedback/logical arguments with relevant proof/citations would be appreciated!

Very good info, thanks for the posting. BUt its still not clear whether the spouse who is on EAD and does not work at all or for that matter 6 months in a given year, will she/he be eligible for setting up a S -corp??

Thanks

sree

I am excerpting Internal Revenue Code Section 1361 below:

Internal Revenue Code

� 1361 S corporation defined.

(a) S corporation defined.

(1) In general.

For purposes of this title, the term �S corporation� means, with respect to any taxable year, a small business corporation for which an election under section 1362(a) is in effect for such year.

(2) C corporation.

For purposes of this title, the term �C corporation� means, with respect to any taxable year, a corporation which is not an S corporation for such year.

(b) Small business corporation.

(1) In general.

For purposes of this subchapter, the term �small business corporation� means a domestic corporation which is not an ineligible corporation and which does not�

(A) have more than 100 shareholders,

(B) have as a shareholder a person (other than an estate, a trust described in subsection (c)(2) , or an organization described in subsection (c)(6) ) who is not an individual,

(C) have a nonresident alien as a shareholder, and

(D) have more than 1 class of stock.

(2) Ineligible corporation defined.

For purposes of paragraph (1) , the term �ineligible corporation� means any corporation which is�

(A) a financial institution which uses the reserve method of accounting for bad debts described in section 585 ,

(B) an insurance company subject to tax under subchapter L,

(C) a corporation to which an election under section 936 applies, or

(D) a DISC or former DISC.

There is no mention here that the "resident" must be a permanent resident.

Here is an excerpt of the Federal Regulation that defines who is a "resident alien" for taxation purposes:

Reg �1.871-2. Determining residence of alien individuals.

Caution: The Treasury has not yet amended Reg � 1.871-2 to reflect changes made by P.L. 108-357

(a) General. The term �nonresident alien individual� means an individual whose residence is not within the United States, and who is not a citizen of the United States. The term includes a nonresident alien fiduciary. For such purpose the term �fiduciary� shall have the meaning assigned to it by section 7701(a)(6) and the regulations in Part 301 of this chapter (Regulations on Procedure and Administration). For presumption as to an alien's nonresidence, see paragraph (b) of �1.871-4.

(b) Residence defined. An alien actually present in the United States who is not a mere transient or sojourner is a resident of the United States for purposes of the income tax. Whether he is a transient is determined by his intentions with regard to the length and nature of his stay. A mere floating intention, indefinite as to time, to return to another country is not sufficient to constitute him a transient. If he lives in the United States and has no definite intention as to his stay, he is a resident. One who comes to the United States for a definite purpose which in its nature may be promptly accomplished is a transient; but, if his purpose is of such a nature that an extended stay may be necessary for its accomplishment, and to that end the alien make his home temporarily in the United States, he becomes a resident, though it may be his intention at all times to return to his domicile abroad when the purpose for which he came has been consummated or abandoned. An alien whose stay in the United States is limited to a definite period by the immigration laws is not a resident of the United States within the meaning of this section, in the absence of exceptional circumstances.

Here is the relevant Federal Regulation on Proof of Residence for determining status for tax purposes:

Reg �1.871-4. Proof of residence of aliens.

(a) Rules of evidence. The following rules of evidence shall govern in determining whether or not an alien within the United States has acquired residence therein for purposes of the income tax.

(b) Nonresidence presumed. An alien, by reason of his alienage, is presumed to be a nonresident alien.

(c) Presumption rebutted.

(1) Departing alien. In the case of an alien who presents himself for determination of tax liability before departure from the United States, the presumption as to the alien's nonresidence may be overcome by proof�

(i) That the alien, at least six months before the date he so presents himself, has filed a declaration of his intention to become a citizen of the United States under the naturalization laws; or

(ii) That the alien, at least six months before the date he so presents himself, has filed Form 1078 or its equivalent; or

(iii) Of acts and statements of the alien showing a definite intention to acquire residence in the United States or showing that his stay in the United States has been of such an extended nature as to constitute him a resident.

(2) Other aliens. In the case of other aliens, the presumption as to the alien's nonresidence may be overcome by proof�

(i) That the alien has filed a declaration of his intention to become a citizen of the United States under the naturalization laws; or

(ii) That the alien has filed Form 1078 or its equivalent; or

(iii) Of acts and statements of the alien showing a definite intention to acquire residence in the United States or showing that his stay in the United States has been of such an extended nature as to constitute him a resident.

(d) Certificate. If, in the application of paragraphs (c)(1)(iii) or (2)(iii) of this section, the internal revenue officer or employee who examines the alien is in doubt as to the facts, such officer or employee may, to assist him in determining the facts, require a certificate or certificates setting forth the facts relied upon by the alien seeking to overcome the presumption. Each such certificate, which shall contain, or be verified by, a written declaration that it is made under the penalties of perjury, shall be executed by some credible person or persons, other than the alien and members of his family, who have known the alien at least six months before the date of execution of the certificate or certificates.

(c) Application and effective dates. Unless the context indicates otherwise, ��1.871-2 through 1.871-5 apply to determine the residence of aliens for taxable years beginning before January 1, 1985. To determine the residence of aliens for taxable years beginning after December 31, 1984, see section 7701(b) and ��301.7701(b)-1 through 301.7701(b)-9 of this chapter. However, for purposes of determining whether an individual is a qualified individual under section 911(d)(1)(A), the rules of ��1.871-2 and 1.871-5 shall continue to apply for taxable years beginning after December 31, 1984. For purposes of determining whether an individual is a resident of the United States for estate and gift tax purposes, see �20.0-1(b)(1) and (2) and � 25.2501-1(b) of this chapter, respectively.

In summary, I submit to you that if you work in the US for more than 6 months out of a given year, you are a resident alien, and therefore are eligible to set up an S-Corp.

Since I am still learning about this, any input/feedback/logical arguments with relevant proof/citations would be appreciated!

Very good info, thanks for the posting. BUt its still not clear whether the spouse who is on EAD and does not work at all or for that matter 6 months in a given year, will she/he be eligible for setting up a S -corp??

Thanks

sree

more...

house Wald Mercedes-Benz S-Class

subujee

09-09 07:53 PM

EVen though I was stuck in labor certification for 5 years and was able to file for my last stages before the mess, still I feel other folks in this immigration community should not be stressed like me . So, even though I can't make it to the immigration rally, I am contributed $100 rightaway and will try to convince my other colleagues on the same boat to contribute.

tattoo 2004 Wald Mercedes-Benz

Libra

09-13 11:42 AM

Thank you mohitb272 for the contribution.

more...

pictures Wald Mercedes-Benz S-Class

Saralayar

01-04 01:25 PM

I also got the same message. But it says document mailed and not as Travel Document approved. What does this mean?. IS the AP approved or any RFE on the AP??:confused:

^^^bump^^^^

^^^bump^^^^

dresses 2006-On MERCEDES BENZ S CLASS

gctoget

08-03 03:51 PM

bunp

more...

makeup Wald Mercedes-Benz S-Class

gc_on_demand

03-09 11:32 AM

For Eb2 india and china dates will be like this in April 2009 bulletin.

Eb2 India : Feb 2005

China : Feb 2006

May 2009 bulletin

Eb2 India : May 2005

China : May 2006

June 2009 bulletin

Eb2 India : Sep 2005

China : Sep 2006

July 2009 bulletin

Eb2 India : Feb 2006

China : Feb 2007

August 2009 bulletin

Eb2 India : May 2007

China : May 2008

Eb2 India : Feb 2005

China : Feb 2006

May 2009 bulletin

Eb2 India : May 2005

China : May 2006

June 2009 bulletin

Eb2 India : Sep 2005

China : Sep 2006

July 2009 bulletin

Eb2 India : Feb 2006

China : Feb 2007

August 2009 bulletin

Eb2 India : May 2007

China : May 2008

girlfriend 2007 Wald Mercedes Benz S

sanagani

03-05 10:43 PM

Even though my priority date is 2005 dec under EB3 , i have one soft LUD on my and my dependentcaseon feb 10 amd one more soft LUD on primary applicant case on feb 27 09...

hairstyles Wald Mercedes-Benz S-Class

gc_chahiye

07-24 12:15 PM

From what I understand many 485 applications(not all)received in accordance to the June bulletin MAY have been preassigned a visa number(from the leftover 60,000 visas) NOT an approval.

source of this information?

Although they are not supposed to pre assign numbers without name checks etc, is'nt it obvious that they might have done that??. They have a lot of cases to approve until Sept 30(from that 60,000 number)

no its not obvious. They have a big backlog of 485s still, and that 60,000 visa numbers can be used up without them having to assign some of those numbers to June 07 filers. See the ombudsmans report for details. If anything, they'll keep some of those visa numbers for people who have been in namecheck long enough, and are expected to get out soon.

there are too many people in teh system already!

source of this information?

Although they are not supposed to pre assign numbers without name checks etc, is'nt it obvious that they might have done that??. They have a lot of cases to approve until Sept 30(from that 60,000 number)

no its not obvious. They have a big backlog of 485s still, and that 60,000 visa numbers can be used up without them having to assign some of those numbers to June 07 filers. See the ombudsmans report for details. If anything, they'll keep some of those visa numbers for people who have been in namecheck long enough, and are expected to get out soon.

there are too many people in teh system already!

amitjoey

07-18 04:29 PM

I do agree , but I do not see any $20 contribution in google checkout or paypal.We have to mail the checks.I guess we can get more donations if we include $25,$50,$75 contributions in google checkout as well as paypal.Correct me If I am missing some thing.

This has been discussed before, People can send in checks of whatever denomination or pay it thru their banks - Set it up as automatic payment every month if they like. (for smaller denominations).

$50 monthly is minimum. In any case, is $50 a big amount? for such a cause?

This has been discussed before, People can send in checks of whatever denomination or pay it thru their banks - Set it up as automatic payment every month if they like. (for smaller denominations).

$50 monthly is minimum. In any case, is $50 a big amount? for such a cause?

Milind123

09-13 08:55 PM

Milind you rock......thanks for efforts.

No thank you Libra for encouraging people to contribute. My new contribution is in my signature.

Now please welcome bala, our special guest, who will take the last shot of this round.

No thank you Libra for encouraging people to contribute. My new contribution is in my signature.

Now please welcome bala, our special guest, who will take the last shot of this round.